In the cosmetic industry, lots of profits are made from making niche products. The likes of aluminum bottles and other metal cosmetic containers. When customized, these metal cosmetic containers give cosmetic products high-end looks.

This is why most clients go ahead to customize aluminum bottles to meet the high-end tastes of their customers.

But then, there is a big problem.

Customizing aluminum bottles domestically is always very expensive. That’s why domestic brands prefer doing it in China.

So, domestic cosmetic brands source for metal cosmetic containers customization companies in China. So that they can help them with customizing their aluminum bottles.

However, doing business in China is not as easy as you think. Compared to doing business domestically. Because you need to know good suppliers and companies. Know what type of printing is better for your aluminum cosmetic containers. And know what import or customs duty you need to pay when importing aluminum bottles from China?

This article would guide you and help to get rid of all these problems.

Here is the import duty you should pay when importing aluminum bottles from China:

- Custom/Import duty

- Merchandising Processing Fee (MPF)

- Harbor Maintenance Fee (HMF)

Also, you need to know:

- The importance of your HS Code

- How to find your HS code

- How to know the import duty by HS code, and

- How to reduce import duty during clearance.

Import Duties when Importing from China

When importing aluminum bottles into the United States, there are certain fees that you must pay. The fees are necessary and are collected and sent by the United States Customs and Border Protection (CBP). It does not matter whether the goods are formal entry, above $2,500. Or informal entry, goods less than $2,500.

The fees you have to pay are as follows:

Customs Duties

Customs duties are also known as import duties. These constitute the main import tax you have to pay when importing aluminum bottles from China.

Any aluminum bottle or metal cosmetic container imported into the United States attracts customs or import duties. Especially if these aluminum bottles are worth $800 or more.

Most times the rate you pay for customs and import duties is specific. Other times they are not. They are rather based on the actual value of your goods.

However, you should know that it is dependent on the HS codes of the aluminum bottle and also its origin.

Merchandising Processing Fee (MPF)

These are additional fees collected by the United States CBP, and they are more or fewer user fees. Any importation of aluminum bottles is subject to processing fees.

The processing fee is always a certain amount. It can range from $2 to about $9 for one informal entry shipment. Formal entry is charged differently.

Harbor Maintenance Fee (HMF)

This is an additional fee charged for importing aluminium bottles or metal cosmetic containers into the United States.

The price of your good HMF is always 0.125% of the value. It’s not charged for air shipments but freight shipments.

How to Find your HS code?

Before we look at how to find your HS codes, let’s see what HS codes are and why you need them.

Remember that your import or customs duty is not only derived from the value of your shipment. Or the type of goods in your shipment. So, it is different for different goods.

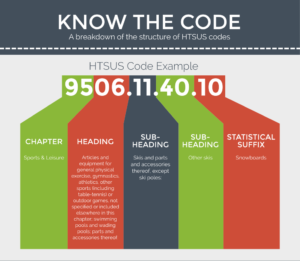

To be able to understand how your import duty is gotten, you need to understand HS codes because they help with the classification of the different types of products.

HS codes make classifying shipped goods easy for customs officers. So it forms a part of a classification system that is recognized worldwide.

In case you didn’t know, HS Codes stands for Harmonized Commodity Description and Coding System.

This system exists to make the classification of your goods simple. You must make sure your goods have the correct HS code. If not, you’ll waste money paying import duty for the wrong goods. That would be very sad.

To find the HS code for your product or aluminum bottle, you need to follow these steps.

You can use a lookup tool for HS codes to quickly search for your product’s HS codes. You have to go to the search bar and type in your product, or metal bottle.

- After this, select the category that your product falls under.

When you are done, you’ll get a code of 6 six digits. This is the first 6 six digits of your HS code. (eg: 7612.90)

Now that you have the first 6 six digits, you need the others to be sure of your aluminum bottle shipment HS code.

You can use the USITC (U.S International Trade Commission) website to get the remaining digits. The steps are as follows:

- Go directly to the USITC search bar and input your product keyword when you do that, different codes will be shown to you.

Look carefully to find the codes that fit your product description

- From there, you can estimate the possible import duty you’ll have to pay.

- But after this, you’ll have to confirm with a trusted freight forwarder or customs broker if it is the same. These people can also help you to successfully clear your goods from customs.

You can use the following links to find the HS code specific to a country

But you can use this link to check for all countries.

How to know the Import Duty by HS Code?

One of the importance of knowing your HS code is to be able to know your import duty. Knowing this will help you avoid costly mistakes. That would cost you lots of money and emotional distress.

Mind you, even though you can know the estimate of your duty by searching, the actual rate would be determined by the United States CBP.

But you can use the following ways to know your import duty using the HS code:

Use the USITC search bar to locate your product category. In this case aluminum bottles or metal cosmetic containers. (HS code 7612.90.10.30)

- Input your product’s HS code in the USITC search bar. This should give you the percentage or rate.

- You can proceed to contact a specialist in customs and border protection or a customs broker for verification or more information.

How to reduce import duty during clearance?

Whether you are buying plenty of aluminum bottles or not, import duty can constitute a financial burden. So there are ways you can use to reduce import duty and taxes.

Personal exemption

Using this method, you don’t have to pay any import duty at all. But in a day, the total value of goods you need to import must not exceed $800.

Batch delivery

Another way to reduce import duty, but not eliminate it, is to send your deliveries in batches. And they would each be sent by international mail. This way, you will ask your supplier to send you delivery in batches that are less than $800.

Sending goods worth more than $2,500 would need a formal entry. Wouldn’t you want to avoid that? Any responsible businessman would.

But this method is as beneficial as it is risky. When caught or if it’s perceived your goods are sent in batches to avoid tax, the exemption would be denied. Another problem is the fact that the express costs might be ridiculously high.

Entrepot or Intermediate Trade

Most times importing aluminum bottles or metal cosmetic containers might be difficult. Especially coming from China to the United States. This could be because of the extra 25% tariff policy that aims only at goods coming from China.

Using a third party, by which we mean, a third country can help reduce your import duty.

That way you send it to the country first. Then sent to the United States.

There are some risks you might encounter. You could lose your goods in transit, especially if your freight forwarder is not trustworthy. Or you could spend too much money trying to transport your aluminum bottles from one country to the next.

Summary

It is important to know what import duty you have to pay. Especially when importing your aluminum bottles and metal cosmetic containers from China.

Knowing these, as well as knowing your HS codes are very important to avoid mistakes. Mistakes that might cost you lots of money.

Following this step-by-step guide will show you how to find your HS code. It will also make knowing your import duty using your HS code easier.

This way, importing aluminum bottles or metal cosmetic containers would not be a hassle for you at all.